Taking control of your finances is one of the most empowering steps you can make toward achieving financial freedom and long-term stability. However, mastering your money often requires guidance, education, and actionable strategies. Fortunately, a wealth of knowledge exists within the pages of some of the best personal finance books available today.

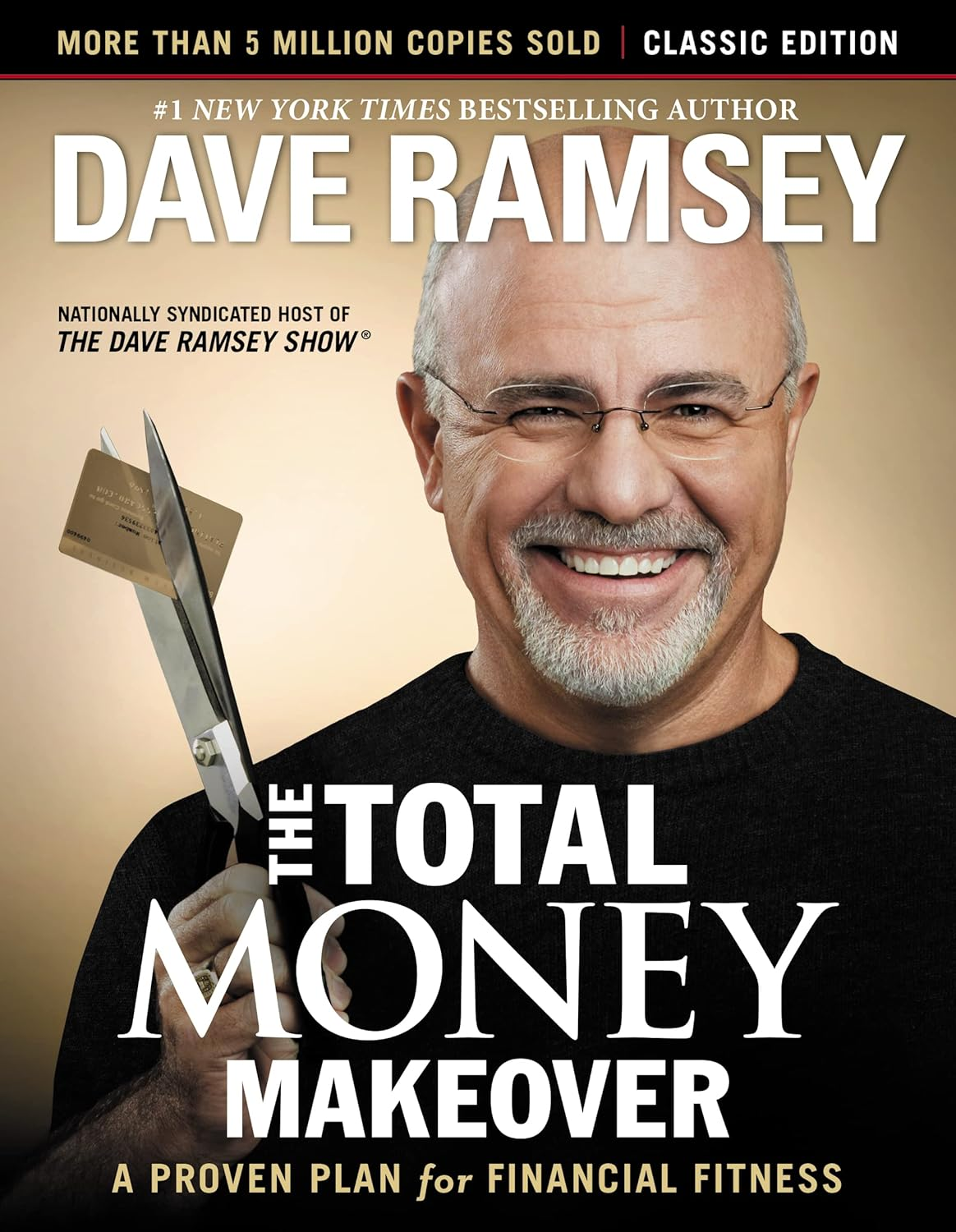

One standout title that has transformed millions of lives and remains an essential read for anyone serious about improving their financial situation is The Total Money Makeover by Dave Ramsey. Renowned for its practical wisdom, straightforward approach, and real-world advice, Ramsey’s classic has earned its place as a must-read book in personal finance.

In this article, we’ll explore why personal finance books matter, highlight the unique value of The Total Money Makeover, and introduce additional valuable resources that can empower you to master your money effectively.

Shop The Total Money Makeover by Dave Ramsey

Why Reading Personal Finance Books Matters

Personal finance books offer invaluable education, guidance, and insights that empower readers to take control of their financial lives. Here are key reasons why reading personal finance literature is essential:

Practical Strategies and Actionable Advice

The best personal finance books provide practical, step-by-step advice for managing money effectively. They equip readers with the tools necessary to budget, save, invest, and eliminate debt systematically.

Enhanced Financial Literacy

Financial literacy is fundamental to achieving long-term success. Personal finance books clearly explain key financial concepts, empowering readers to make informed decisions, avoid costly mistakes, and build strong financial foundations.

Motivation and Inspiration

Beyond practical guidance, financial books often include motivational insights and inspiring success stories. These narratives encourage readers to maintain discipline, focus on goals, and remain committed to their financial journeys.

Lifelong Financial Habits

Books focused on personal finance help readers cultivate healthy financial habits that last a lifetime. By promoting budgeting, disciplined saving, debt elimination, and strategic investing, these books facilitate lasting financial success.

Shop The Total Money Makeover by Dave Ramsey

Featured Product: The Total Money Makeover by Dave Ramsey

Among personal finance classics, The Total Money Makeover by renowned financial expert Dave Ramsey is consistently praised for its clarity, practicality, and powerful impact. Ramsey’s straightforward yet transformative approach has helped millions of readers eliminate debt, build wealth, and achieve financial freedom.

Proven Financial Strategies

Ramsey’s method is built around clear, actionable financial strategies such as budgeting, paying off debt using his famous “Debt Snowball” method, establishing emergency funds, and investing wisely. These practical steps make financial success attainable for anyone, regardless of income level or past financial mistakes.

Motivational and Straightforward Approach

Ramsey’s writing style is direct, honest, and motivational. He effectively communicates the urgency of taking control of your finances, providing readers with motivation and determination to implement meaningful changes immediately.

Real-Life Success Stories

One of the most inspiring features of The Total Money Makeover is the collection of genuine success stories shared by individuals and families who successfully implemented Ramsey’s principles. These relatable accounts provide powerful motivation, demonstrating achievable results and tangible financial transformations.

Emphasis on Long-Term Wealth-Building

Ramsey’s book emphasizes the importance of long-term wealth-building through consistent saving, investing, and disciplined financial behavior. His approach instills patience, discipline, and commitment—key qualities necessary for sustainable financial prosperity.

Shop The Total Money Makeover by Dave Ramsey

Why The Total Money Makeover is Essential Reading

Including The Total Money Makeover in your personal finance library offers numerous benefits that significantly enhance your financial journey:

Clear, Step-by-Step Financial Roadmap

Ramsey’s clearly defined “Baby Steps” provide a structured roadmap, guiding readers through each stage of financial management—from eliminating debt to building lasting wealth. This straightforward system simplifies financial decisions, reducing stress and uncertainty.

Debt Reduction and Freedom from Financial Burden

Ramsey’s famous “Debt Snowball” method has helped countless individuals rapidly eliminate debt, creating financial freedom and dramatically reducing stress. This practical approach offers powerful motivation, fueling determination and perseverance.

Encourages Responsible Financial Behavior

Ramsey emphasizes responsible financial practices, including disciplined budgeting, consistent saving, and avoiding unnecessary debt. This responsible behavior builds strong financial foundations, ensuring long-term success and stability.

Shop The Total Money Makeover by Dave Ramsey

Additional Essential Personal Finance Books to Consider

While The Total Money Makeover is a powerful starting point, numerous other valuable resources provide additional insights and strategies for mastering personal finances:

- Rich Dad Poor Dad by Robert Kiyosaki: Offers insights on financial education, investment strategies, and wealth-building mindsets, reshaping how readers think about money and assets.

- The Millionaire Next Door by Thomas J. Stanley & William D. Danko: Reveals surprising habits of everyday millionaires, highlighting practical strategies for achieving financial success through disciplined living and investing.

- Your Money or Your Life by Vicki Robin & Joe Dominguez: Combines personal finance with mindful living, teaching readers to align spending habits with personal values for enhanced happiness and financial security.

- I Will Teach You to Be Rich by Ramit Sethi: Provides modern, actionable advice for earning, saving, and investing wisely, emphasizing automated systems and personal finance optimization.

Practical Tips to Implement Personal Finance Advice Effectively

Reading personal finance books is just the beginning. Successfully mastering your money involves consistent action and discipline. Consider these practical tips for implementing financial advice from your reading:

Set Clear Financial Goals

Clearly define short-term and long-term financial goals, establishing benchmarks to measure your progress. Goals keep you motivated, accountable, and focused on financial success.

Create and Follow a Budget

A detailed budget ensures responsible spending, consistent saving, and strategic investing. Budgeting allows informed financial decisions, helping you remain disciplined and focused.

Regularly Track Financial Progress

Monitor your financial progress regularly to assess your strategies’ effectiveness. Tracking improvements provides motivation, highlights successes, and reveals areas needing further adjustment.

Shop The Total Money Makeover by Dave Ramsey

Why Readers Love The Total Money Makeover by Dave Ramsey

Readers consistently choose The Total Money Makeover for compelling reasons:

- Clear, practical financial strategies for debt elimination and wealth-building.

- Motivational approach, inspiring immediate action and lasting commitment.

- Proven effectiveness, demonstrated through countless reader success stories.

- Realistic, straightforward advice applicable to diverse financial situations.

Conclusion: Master Your Money with The Total Money Makeover

Achieving financial success and stability begins with knowledge, actionable strategies, and consistent discipline. The Total Money Makeover by Dave Ramsey provides precisely these tools, empowering you to eliminate debt, build wealth, and create lasting financial freedom.

By thoughtfully reading, understanding, and implementing practical financial advice, you significantly enhance your financial health and future security. Explore The Total Money Makeover and additional personal finance classics, and begin your transformative journey toward mastering your money effectively today.

Shop The Total Money Makeover by Dave Ramsey

FAQ Section

- Is The Total Money Makeover suitable for beginners?

Yes, Dave Ramsey’s book clearly explains fundamental financial concepts, making it accessible and practical for anyone beginning their financial journey. - What is the “Debt Snowball” method described in Ramsey’s book?

The Debt Snowball method involves listing debts from smallest to largest and aggressively paying off the smallest debts first, building momentum and motivation to eliminate debt faster. - How quickly can someone see results by following The Total Money Makeover?

Results vary based on individual circumstances, but readers often report significant improvements in financial habits and reduced debt within a few months of dedicated effort. - Can The Total Money Makeover help people with high debt levels?

Absolutely. Ramsey’s practical, motivational advice provides effective strategies for managing and eliminating substantial debts, guiding readers toward financial freedom regardless of debt levels. - Are additional resources recommended after The Total Money Makeover?

Yes, exploring other personal finance books such as Rich Dad Poor Dad, Your Money or Your Life, and The Millionaire Next Door enhances your financial literacy, strategy diversity, and long-term success.